Introduction

The greatest investors have not only amassed immense wealth but also left a lasting impact on global financial markets. By examining their unique strategies, we can glean insights into long-term wealth creation, risk management, and investment philosophy. These 11 investors have mastered the art of investing, offering invaluable lessons for both amateur and professional traders alike.

1. Warren Buffett: The Oracle of Omaha

Investment Strategy

Warren Buffett, often regarded as the greatest investor of all time, is famous for his value investing approach, which he learned from his mentor, Benjamin Graham. Buffett’s philosophy is to buy stocks that are undervalued but have strong fundamentals, and then hold them for the long term. His holding company, Berkshire Hathaway, owns major stakes in companies like Coca-Cola, American Express, and Apple.

Key Lessons

- Invest in what you understand.

- Look for businesses with strong management and competitive advantages.

- Be patient; great investments take time to flourish.

2. George Soros: The Man Who Broke the Bank of England

Investment Strategy

George Soros is known for his global macro strategy, making massive bets on currencies and interest rates based on macroeconomic trends. In 1992, Soros famously shorted the British pound, earning over $1 billion in a single day, a feat that earned him his legendary status in the financial world.

Key Lessons

- Bold, high-risk bets can yield high rewards if based on solid economic analysis.

- Have the courage to go against the crowd when necessary.

- Stay attuned to macroeconomic signals and political trends.

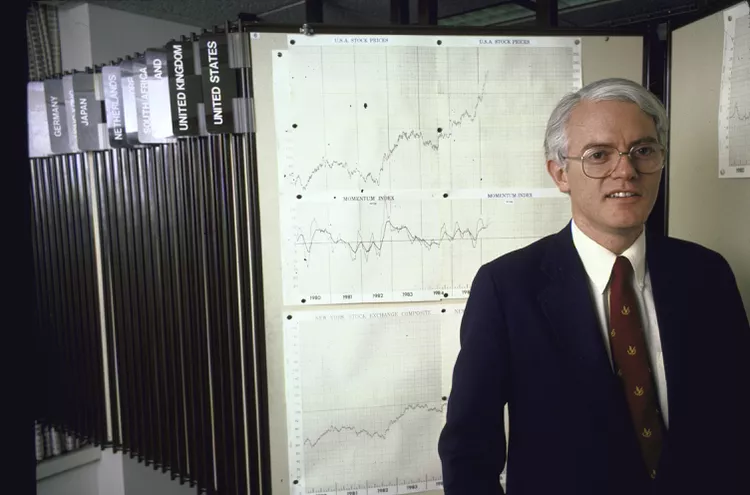

3. Peter Lynch: Magellan Fund’s Star Manager

Investment Strategy

Peter Lynch managed the Magellan Fund at Fidelity Investments from 1977 to 1990, delivering an average annual return of 29%. Lynch believed in a “buy what you know” approach, encouraging investors to invest in companies they understand and use in their daily lives. He emphasized growth investing, targeting companies with the potential to expand rapidly.

Key Lessons

- Look for companies with strong earnings growth.

- Perform thorough research, and trust your knowledge of products and industries.

- Diversify your portfolio to mitigate risk.

4. Benjamin Graham: The Father of Value Investing

Investment Strategy

Benjamin Graham, author of “The Intelligent Investor,” pioneered the concept of value investing. He taught that investors should focus on the intrinsic value of a stock and purchase shares when they are priced below their actual worth. Graham believed in rigorous financial analysis and was a mentor to Warren Buffett.

Key Lessons

- Always prioritize risk management.

- Buy undervalued stocks and hold them until the market realizes their value.

- Avoid speculation and short-term thinking.

5. John Templeton: The International Investor

Investment Strategy

John Templeton was one of the first investors to explore opportunities beyond the U.S. market. He believed in contrarian investing, buying stocks in emerging markets or industries that were out of favor. His strategy of finding global bargains helped him achieve extraordinary returns.

Key Lessons

- Be a contrarian: invest in sectors and regions that are overlooked.

- Diversify your investments geographically to reduce risk.

- Always remain open-minded to new opportunities around the world.

6. Carl Icahn: The Corporate Raider

Investment Strategy

Carl Icahn is known for his activist investing, where he buys significant shares in companies and then pressures management to make changes that increase shareholder value. Icahn has been involved in several high-profile takeovers and is famous for his aggressive strategies to unlock value.

Key Lessons

- Engage with management to improve company performance.

- Look for companies with undervalued assets.

- Be willing to take on a fight to ensure the company operates in the best interest of shareholders.

7. Ray Dalio: The Bridgewater Founder

Investment Strategy

Ray Dalio founded Bridgewater Associates, the world’s largest hedge fund. He is known for his principled approach to investing, which focuses on understanding economic cycles and leveraging diversification to manage risk. His “All Weather” strategy aims to perform well across all types of market environments.

Key Lessons

- Emphasize diversification to balance risk.

- Study historical trends and patterns to predict future movements.

- Develop a set of guiding principles that inform every investment decision.

8. Charlie Munger: Buffett’s Right-Hand Man

Investment Strategy

As Warren Buffett’s business partner, Charlie Munger is less well-known but equally important. Munger’s investment strategy mirrors Buffett’s, focusing on value investing and long-term growth. However, Munger places a greater emphasis on rationality and the importance of mental models in decision-making.

Key Lessons

- Focus on rational thinking and avoid emotional decision-making.

- Develop a wide understanding of various disciplines to improve investment analysis.

- Patience is key in finding the right opportunities.

FAQ: Frequently Asked Questions

1. Who is the greatest investor of all time?

Warren Buffett is widely regarded as the greatest investor, known for his consistent application of value investing and long-term success with Berkshire Hathaway.

2. What is value investing?

Value investing is a strategy that involves buying stocks that appear undervalued compared to their intrinsic value, often based on fundamental analysis.

3. How did George Soros “break the Bank of England”?

Soros made a massive bet against the British pound in 1992, shorting the currency and earning $1 billion when the UK government was forced to devalue the pound.

4. What is Peter Lynch’s famous investment principle?

Peter Lynch’s “buy what you know” strategy emphasizes investing in companies that you understand from personal experience or research.

5. How does Ray Dalio approach risk management?

Ray Dalio uses a highly diversified portfolio, aiming to perform well across all market environments by understanding economic cycles and managing risk.