Investing can be an intimidating venture, especially for those just starting out. However, understanding the landscape and having a clear strategy can pave the way for successful investments. As we look into 2024, let’s delve into the best investment opportunities for beginners, highlighting essential market trends and strategies.

Understanding the Current Market Landscape

Economic Overview

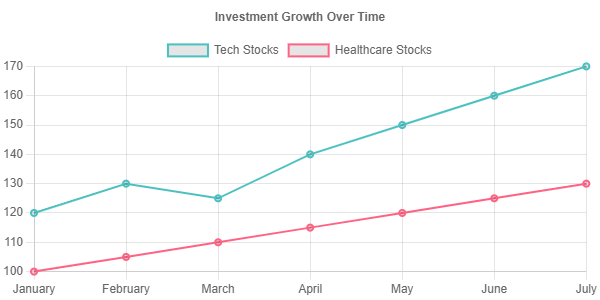

As we enter 2024, the economic environment is marked by a mix of optimism and caution. The first quarter has seen notable growth in technology and artificial intelligence (AI) sectors. Investors are particularly enthusiastic about the potential of AI across various industries, which has contributed to a surge in tech stocks.

However, recent data reveals a deceleration in U.S. job growth, with April’s figures showing the lowest increase in six months. The annual wage growth fell below 4% for the first time since 2021, and the unemployment rate ticked up to 3.9%. These indicators suggest a cooling labor market, prompting investors to reassess their strategies.

Inflation and Interest Rates

Inflation, while decreasing from its peak in mid-2022, remains a concern, hovering around 3%. The Federal Reserve’s stance on interest rates has been cautious, with Governor Michelle Bowman indicating a willingness to adjust rates if inflation trends stall. This backdrop of fluctuating economic indicators creates both challenges and opportunities for investors.

Top Investment Strategies for Beginners

For those new to investing, focusing on established companies with strong financial fundamentals can significantly reduce risk. Here are some strategies to consider:

Building a Diversified Portfolio

Diversification is crucial in mitigating risk. By spreading investments across various sectors, beginners can protect themselves from volatility in any single market.

Investing in Index Funds and ETFs

For those who prefer a hands-off approach, index funds and exchange-traded funds (ETFs) offer a way to invest in a broad market without having to pick individual stocks. These funds typically have lower fees and can provide steady returns.

Focusing on Dividend Stocks

Dividend-paying stocks can provide a reliable income stream. Companies with a history of consistent dividends tend to be financially stable, making them attractive to beginners.

Top 12 Investment Picks for 2024

- Microsoft Corporation (NASDAQ: MSFT)

A leader in technology, Microsoft continues to expand its cloud services and AI capabilities. - Amazon.com, Inc. (NASDAQ: AMZN)

With a robust e-commerce platform and growing cloud services, Amazon remains a strong investment choice. - Mastercard Incorporated (NYSE: MA)

As digital payments grow, Mastercard’s position in the financial services sector makes it a compelling option. - JPMorgan Chase & Co. (NYSE: JPM)

A well-established bank with a diverse range of services, it offers stability and growth potential. - Adobe Inc. (NASDAQ: ADBE)

Known for its creative software, Adobe is also expanding into AI-driven solutions. - Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM)

As a leader in semiconductor manufacturing, TSMC is crucial to the tech supply chain. - Berkshire Hathaway Inc. (NYSE: BRK-B)

This conglomerate, led by Warren Buffett, includes a diverse portfolio of businesses. - Salesforce, Inc. (NYSE: CRM)

A leader in customer relationship management, Salesforce continues to innovate in cloud computing. - Alphabet Inc. (NASDAQ: GOOG)

The parent company of Google, Alphabet is at the forefront of digital advertising and AI. - NVIDIA Corporation (NASDAQ: NVDA)

With its leading position in graphics processing units (GPUs), NVIDIA is pivotal in AI and gaming. - Coca-Cola Company (NYSE: KO)

A classic dividend stock, Coca-Cola offers stability and a consistent payout. - Visa Inc. (NYSE: V)

Another major player in digital payments, Visa benefits from the global shift towards cashless transactions.

Frequently Asked Questions

1. Why should beginners focus on well-known companies?

Well-known companies typically have established reputations, strong financial health, and a history of stability. This reduces the risks associated with investing, making them safer options for beginners.

2. How can beginners start investing in stocks?

To begin investing, beginners should open a brokerage account, conduct thorough research on potential investments, and consider starting with index funds or ETFs for diversification.

3. What are some common mistakes beginners make when investing?

Common pitfalls include failing to diversify, allowing emotions to drive investment decisions, and neglecting to do proper research before investing.

4. How important is it to follow market trends?

Staying informed about market trends is crucial as it helps investors make educated decisions and adjust their strategies according to economic changes.

5. Are there risks involved in investing for beginners?

Yes, investing always carries risks. However, by focusing on established companies and maintaining a diversified portfolio, beginners can mitigate some of these risks and enhance their chances of success.

In summary, while the journey into investing may seem overwhelming, a structured approach and knowledge of the market can empower beginners to make informed decisions. By focusing on established companies and diversifying their investments, they can build a solid foundation for their financial future.